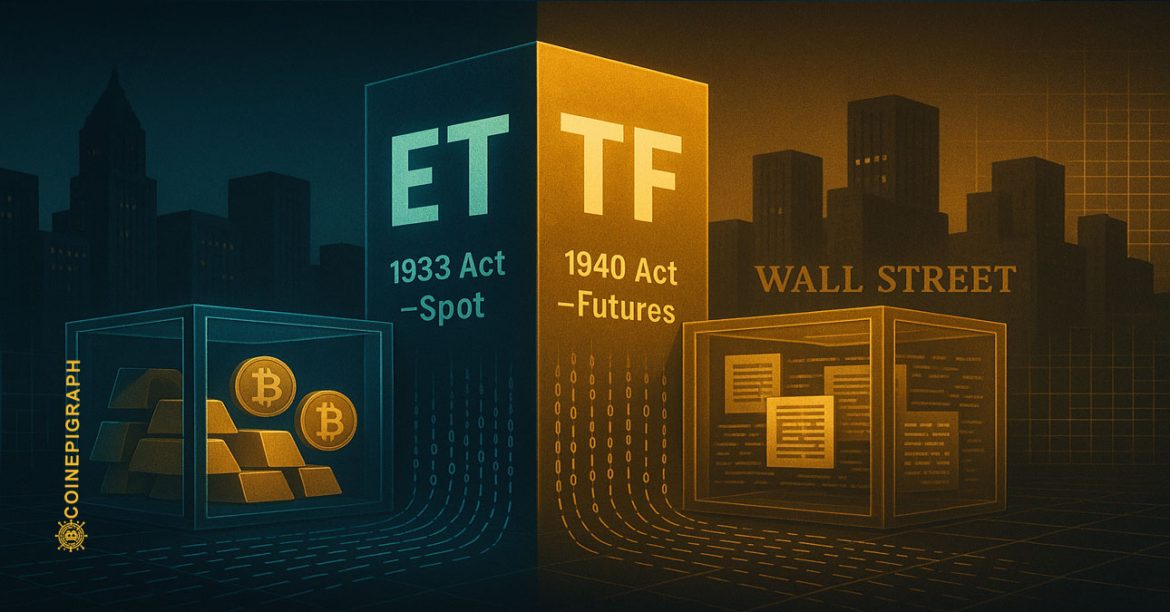

Behind the tickers and trading apps, two distinct legal engines drive the ETF universe. Understanding the difference between 1933-Act “spot” ETFs and 1940-Act “futures” ETFs can help investors navigate what they’re really buying — and why it matters in a world now bridging Wall Street and Web3.

By CoinEpigraph Editorial Desk | November 18, 2025

The Quiet Divide Most Investors Miss

Exchange-traded funds (ETFs) are the most popular financial products of the past two decades. But what most investors don’t realize is that not all ETFs are built the same.

Two parallel rulebooks — the Securities Act of 1933 and the Investment Company Act of 1940 — determine how an ETF operates, what assets it can hold, and how it’s taxed.

Those numbers, 1933 and 1940, aren’t trivia. They represent a deep split between spot-based funds that hold physical or digital assets and futures-based funds that gain exposure through derivatives.

Understanding that divide is essential before you open an account with Vanguard, BlackRock, or any crypto-linked ETF provider.

1933 Act ETFs: The “Spot” or “Physical” Model

ETFs registered under the Securities Act of 1933 are structured as commodity or grantor trusts rather than mutual-fund companies.

How They Work

- The trust directly holds the underlying asset — gold bars, silver, or bitcoin.

- Investors buy shares that represent fractional ownership of those assets.

- No derivatives, no leverage, no active management.

Real-World Examples

- SPDR Gold Shares (GLD)

- iShares Silver Trust (SLV)

- BlackRock iShares Bitcoin Trust (IBIT)

These vehicles offer pure price exposure. If gold or bitcoin rises 5 %, the ETF should closely mirror that move (minus minor custody and management costs).

Why It Matters

Because 1933 Act ETFs hold the real thing, they appeal to investors seeking direct market truth — exposure without abstraction. They sit outside the 1940 Act’s limits on leverage and diversification, giving issuers more freedom but also less regulatory oversight.

1940 Act ETFs: The “Futures” or “Cayman Subsidiary” Model

ETFs registered under the Investment Company Act of 1940 are traditional investment companies — the same legal class as mutual funds.

How They Work

- These funds typically hold futures contracts or other derivatives rather than the spot asset.

- Because U.S. tax rules restrict direct commodity holdings inside a regulated investment company, the fund forms a Cayman Islands subsidiary to trade futures on its behalf.

- The parent fund owns 100 % of that subsidiary, consolidating results for investors.

Real-World Examples

- ProShares Bitcoin Strategy ETF (BITO) — uses CME Bitcoin futures.

- Various oil and commodity strategy ETFs.

Why It Matters

This structure lets investors gain exposure to commodity-style assets through a regulated, 1940-Act framework. But it also introduces tracking error (because futures roll differently from spot prices) and complex tax treatment.

These funds are more tightly supervised — diversification limits, liquidity rules, and daily NAV reporting all apply.

Key Differences at a Glance

| Feature | 1933 Act ETF | 1940 Act ETF |

|---|---|---|

| Governing Law | Securities Act of 1933 | Investment Company Act of 1940 |

| Legal Form | Commodity / Grantor Trust | Registered Investment Company |

| Core Asset | Spot commodity or crypto | Futures or derivative contracts |

| Cayman Subsidiary Use | None | Common (for futures) |

| Oversight Agency | SEC / CFTC (limited) | SEC + CFTC dual oversight |

| Leverage Allowed | Generally no | Limited within rules |

| Typical Tax Form | Grantor Trust / K-1 | Regulated Investment Company |

| Examples | GLD, IBIT | BITO, Oil Strategy ETFs |

Why Investors Should Care

1. Performance Tracking

Spot ETFs tend to mirror the underlying market closely. Futures ETFs depend on contract roll schedules and may deviate from spot returns.

2. Tax and Reporting

1933 Act ETFs often issue K-1 forms; 1940 Act ETFs distribute standard 1099s. For institutional or IRA investors, that difference matters.

3. Regulatory Comfort

Traditional fund managers, pensions, and advisers often prefer 1940 Act vehicles because they fit existing compliance infrastructure. Retail or crypto-native investors may favor the purity of 1933 Act trusts.

4. Narrative Positioning

Spot funds trade on reality — the actual asset. Futures funds trade on perception — an engineered exposure to that reality. Knowing which you own defines whether you’re buying belief or substance.

Bridging Wall Street and Web3

The arrival of spot Bitcoin ETFs in 2024 blurred the line between decentralized assets and regulated wrappers. For the first time, investors could own on-chain value through Wall Street rails.

Understanding the 1933 vs. 1940 framework will matter even more as issuers like Vanguard and BlackRock expand into tokenized funds, Ethereum products, and synthetic baskets.

The next generation of ETFs won’t just be about exposure — it will be about translating the language of crypto into the grammar of finance.

At CoinEpigraph, we are committed to delivering digital-asset journalism with clarity, accuracy, and uncompromising integrity. Our editorial team works daily to provide readers with reliable, insight-driven coverage across an ever-shifting crypto and macro-financial landscape. As we continue to broaden our reporting and introduce new sections and in-depth op-eds, our mission remains unchanged: to be your trusted, authoritative source for the world of crypto and emerging finance.

— Ian Mayzberg, Editor-in-Chief

The team at CoinEpigraph.com is committed to independent analysis and a clear view of the evolving digital asset order.

To help sustain our work and editorial independence, we would appreciate your support of any amount of the tokens listed below. Support independent journalism:

BTC: 3NM7AAdxxaJ7jUhZ2nyfgcheWkrquvCzRm

SOL: HxeMhsyDvdv9dqEoBPpFtR46iVfbjrAicBDDjtEvJp7n

ETH: 0x3ab8bdce82439a73ca808a160ef94623275b5c0a

XRP: rLHzPsX6oXkzU2qL12kHCH8G8cnZv1rBJh TAG – 1068637374

SUI – 0xb21b61330caaa90dedc68b866c48abbf5c61b84644c45beea6a424b54f162d0c

and through our Support Page.

🔍 Disclaimer: CoinEpigraph is for entertainment and information, not investment advice. Markets are volatile — always conduct your own research.

COINEPIGRAPH does not offer investment advice. Always conduct thorough research before making any market decisions regarding cryptocurrency or other asset classes. Past performance is not a reliable indicator of future outcomes. All rights reserved ™ © 2024-2028.