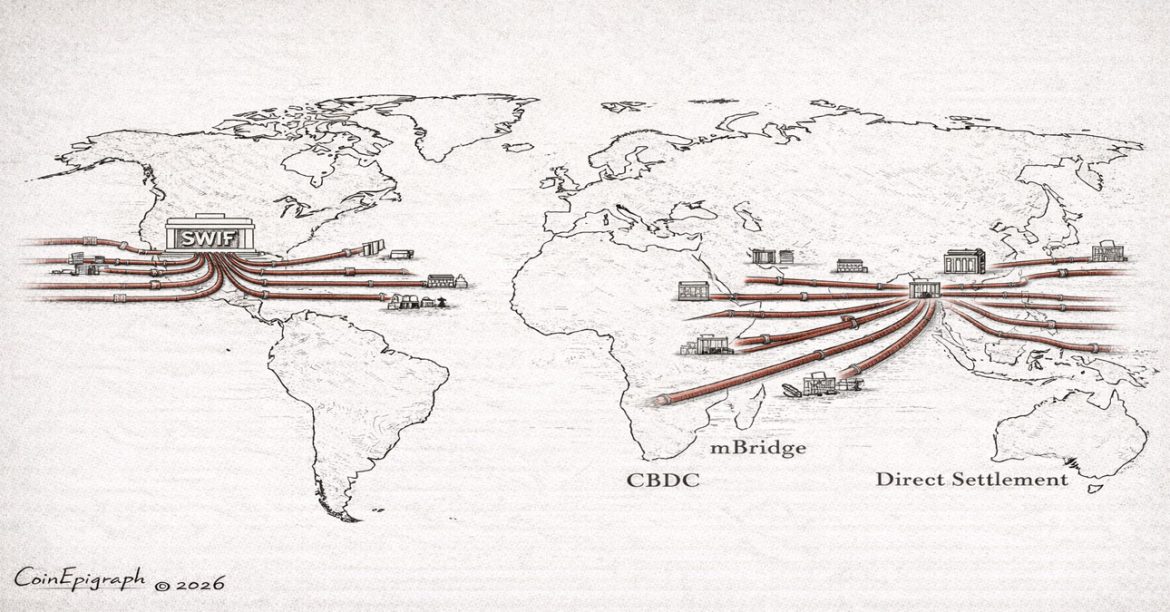

From Society for Worldwide Interbank Financial Telecommunication to the Bank for International Settlements and its mBridge Project pilots, the future of currency influence may hinge less on politics and more on plumbing.

By CoinEpigraph Editorial Desk | February 9, 2026

The dollar did not conquer the world with speeches.

It conquered it with plumbing.

Wires.

Clearinghouses.

Correspondent accounts.

Settlement messages moving invisibly between banks at the end of each day.

For half a century, the architecture beneath global finance has favored one path. If you wanted to move value across borders at scale, you passed through the same corridors. Those corridors spoke dollars.

Over time, that routing logic hardened into dominance.

Not because every country preferred the dollar.

Because the dollar was simply the easiest rail to ride.

That distinction matters now.

Because rails are changing.

Messaging became money

At the center of the legacy system sits SWIFT — a network so embedded it often disappears from discussion. It doesn’t hold funds. It doesn’t clear trades. It sends messages. Payment instructions. Confirmations. Settlement notes.

But in finance, messaging is destiny.

If every bank routes through the same message layer, the currencies traveling through it inherit advantage. Liquidity pools where communication is fastest. Costs fall where networks are thickest. The rest of the world adapts.

Over decades, that quiet convenience compounded.

Trade invoices defaulted to dollars.

Commodity contracts settled in dollars.

Central banks stockpiled dollars.

Not ideology. Friction.

The dollar reduced it.

So the dollar won.

A system built for yesterday’s speed

The problem is not that SWIFT works poorly. It works exactly as designed — for an earlier era.

Cross-border transfers still feel like mail, not electricity.

Two days here. Three days there.

Multiple intermediaries.

Layered fees.

Opaque timing.

In a world of instant communication, value still moves as if fax machines are involved.

For years, that inefficiency was tolerated because there was no credible alternative. Correspondent banking was messy but familiar. Dollar clearing was slow but predictable.

Then the settlement layer started evolving.

Quietly. Almost academically at first.

The central banks noticed first

While crypto markets argued about tokens and prices, policy desks were experimenting with something more fundamental: how money itself moves between institutions.

The Bank for International Settlements, sometimes described as the central bank for central banks, began coordinating cross-border trials. The question was simple but consequential:

What if settlement didn’t require intermediaries at all?

What if central banks could transact directly on shared ledgers, with atomic finality, in minutes instead of days?

The result was mBridge — a multi-central bank digital currency platform that allows participating monetary authorities to settle trades across borders using tokenized representations of their own currencies.

No correspondent chain.

No message relay.

No implicit dollar step in the middle.

Just direct exchange.

From a technical perspective, it is elegant.

From a geopolitical perspective, it is disruptive.

Settlement is power

Currency dominance has always rested on three pillars:

Liquidity.

Trust.

Settlement convenience.

The first two remain firmly in the dollar’s favor. U.S. markets are still the deepest in the world. Treasuries still function as global collateral.

But the third pillar — convenience — is infrastructure.

And infrastructure can be replaced.

If two countries can settle trade instantly using interoperable digital currencies, routed through a neutral platform, the practical need to touch the dollar diminishes.

Not disappears.

Diminishes.

That’s how influence erodes in modern finance — not through declarations, but through optionality.

When alternatives exist, dependency softens.

This is not de-dollarization theater

The phrase “de-dollarization” gets tossed around like a slogan. It implies rebellion, or coordinated strategy, or dramatic shifts.

Reality is usually duller.

And more decisive.

Most changes in global finance happen not because actors want to abandon something, but because they discover a cheaper path.

No one staged a protest against fax machines. Email simply worked better.

No one voted to eliminate floor trading. Electronic matching engines reduced friction.

If settlement through platforms like mBridge becomes faster, cheaper, and programmable, usage will follow. Not as protest. As optimization.

The dollar’s role then changes at the margin.

Margins, compounded, become trends.

The BIS paradox

There’s an irony embedded in the story.

The same institutions that anchored the postwar dollar system are now experimenting with the tools that may dilute it.

The BIS is not an insurgent organization. It is the custodian of stability. Yet its pilots acknowledge a reality: the correspondent banking model is aging.

Central banks want:

- faster settlement

- lower counterparty risk

- programmable compliance

- fewer intermediaries

Digital ledgers offer those attributes.

So they test.

They iterate.

They build.

And once built, systems rarely remain unused.

Where SWIFT fits in

This does not spell immediate obsolescence for SWIFT. Networks of that scale evolve rather than vanish. Messaging layers can adapt. Integration is possible. Hybrid models will emerge.

But the monopoly on routing is gone.

For the first time in decades, meaningful alternatives exist at the sovereign level.

When routing is plural, influence fragments.

And fragmentation, in currency markets, is everything.

Dominance depends on habit. Habits depend on convenience.

Break the convenience, and habits loosen.

The quieter implications

For investors and policymakers, the takeaway is less dramatic than headlines suggest.

The dollar is not collapsing.

It is normalizing.

Instead of functioning as the unavoidable middleman in nearly every transaction, it may gradually become one option among several.

Still powerful. Still liquid. Just less automatic.

That shift has second-order effects:

Reserves diversify.

Trade settles regionally.

Collateral pools widen.

Sanction leverage narrows.

Nothing snaps.

The system simply redistributes weight.

Look beneath the headlines

Most financial stories focus on the surface — exchange rates, political rhetoric, summits and speeches.

But currencies live and die beneath the surface.

In settlement code.

In custody rules.

In the pipes connecting one ledger to another.

That’s where the real contest plays out.

For decades, the dollar owned the pipes.

Now new conduits are being laid.

Not loudly. Not theatrically.

Just steadily.

And in infrastructure, steady change tends to win.

Because once a better rail exists, traffic finds it.

It always does.

The rest is just timing.

At CoinEpigraph, we are committed to delivering digital-asset journalism with clarity, accuracy, and uncompromising integrity. Our editorial team works daily to provide readers with reliable, insight-driven coverage across an ever-shifting crypto and macro-financial landscape. As we continue to broaden our reporting and introduce new sections and in-depth op-eds, our mission remains unchanged: to be your trusted, authoritative source for the world of crypto and emerging finance.

— Ian Mayzberg, Editor-in-Chief

The team at CoinEpigraph.com is committed to independent analysis and a clear view of the evolving digital asset order.

To help sustain our work and editorial independence, we would appreciate your support of any amount of the tokens listed below. Support independent journalism:

BTC: 3NM7AAdxxaJ7jUhZ2nyfgcheWkrquvCzRm

SOL: HxeMhsyDvdv9dqEoBPpFtR46iVfbjrAicBDDjtEvJp7n

ETH: 0x3ab8bdce82439a73ca808a160ef94623275b5c0a

XRP: rLHzPsX6oXkzU2qL12kHCH8G8cnZv1rBJh TAG – 1068637374

SUI – 0xb21b61330caaa90dedc68b866c48abbf5c61b84644c45beea6a424b54f162d0c

and through our Support Page.

🔍 Disclaimer: CoinEpigraph is for entertainment and information, not investment advice. Markets are volatile — always conduct your own research.

COINEPIGRAPH does not offer investment advice. Always conduct thorough research before making any market decisions regarding cryptocurrency or other asset classes. Past performance is not a reliable indicator of future outcomes. All rights reserved ™ © 2024-2028.