Are liquidity regimes and AI adoption reshaping the dominance of mega-cap growth?

By CoinEpigraph Editorial Desk | February 19, 2026

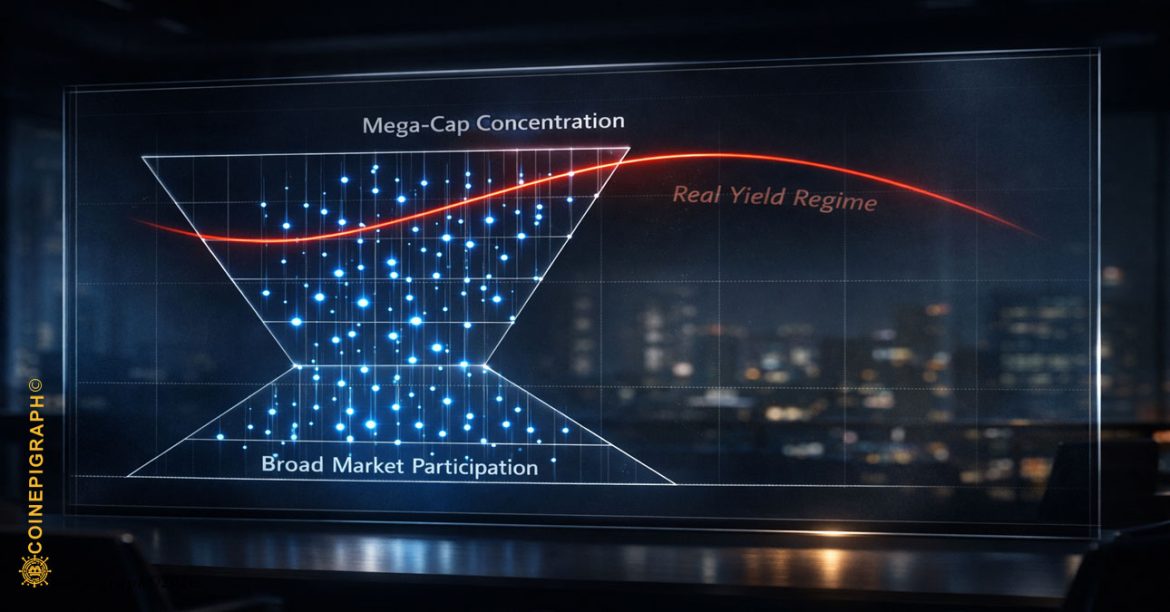

For more than a decade, market leadership has been unusually concentrated.

Mega-cap technology firms — often grouped under shorthand labels such as the “Magnificent Seven” — captured disproportionate index weight, capital flows, and valuation expansion. Their dominance reflected structural conditions: compressed real yields, low funding costs, duration premium expansion, and scalable network effects that rewarded size.

But market structures evolve.

Recent strength in small-cap breadth, particularly within the Russell 2000, alongside accelerating artificial intelligence adoption across mid-sized and smaller firms, raises a structural question: is capital rotating merely on valuation grounds, or is productivity diffusion reshaping relative earnings leverage across the market?

This is not a narrative about collapse. It is a question of repricing mechanics.

The Real Yield Anchor

Real yields remain the gravitational force beneath equity leadership. When real yields compress, discount rates fall. Long-duration cash flows inflate. Growth multiples expand. Capital favors scale, optionality, and distant earnings streams.

Mega-cap technology firms thrived under that regime. Their extended duration profile — earnings weighted heavily toward the future — benefited disproportionately from low real yields.

As real yields normalize or rise, the duration advantage compresses. The present value of distant cash flows declines relative to nearer-term earnings. The result is not necessarily a decline in mega-cap fundamentals, but a recalibration of valuation premiums.

Re-calibration creates space.

AI as a Productivity Variable

Artificial intelligence is not simply a thematic growth story. It is a cost structure lever.

Smaller and mid-sized firms deploying AI into operations are reporting faster data analysis cycles, automation-driven cost reductions, and improved margin expansion. Historically, scale provided a productivity moat. Large firms could amortize fixed costs across broad user bases, invest in proprietary systems, and maintain operational efficiency advantages.

AI diffusion narrows that gap.

When productivity tools become widely accessible, competitive advantage shifts from sheer scale to implementation speed and operational integration. A firm that deploys AI effectively can compress labor intensity and enhance output without proportional capital expansion.

Markets eventually price earnings leverage.

Russell Breadth and Rotation Signals

The Russell 2000 represents broad small-cap exposure, often tied more closely to domestic economic conditions than global platform dominance. Sustained relative strength in small caps can signal risk capital broadening beyond concentrated mega-cap exposure.

Short-term rotations are common in equity cycles. But when breadth expansion coincides with structural shifts in productivity and funding costs, the signal becomes more interesting.

If smaller firms can improve margins through AI while mega-cap valuations face sensitivity to real-yield normalization, relative performance can converge without a dramatic unwind in large-cap fundamentals.

Leadership does not collapse; it diffuses.

Infrastructure Spillover and Ethereum Connectivity

The emergence of infrastructure-native firms operating on modular financial rails adds another dimension. Companies connected to programmable settlement systems, tokenization frameworks, and decentralized financial layers operate without certain legacy overhead burdens.

Lower capital intensity can translate into higher return on invested capital when execution is disciplined. While early-stage infrastructure remains volatile, the broader implication is structural: financial architecture is becoming more composable.

Reduced friction in settlement and programmable financial logic can support faster experimentation, lower marginal transaction costs, and new capital formation channels.

Markets reward efficiency when liquidity permits.

Funding Sensitivity and Neo-Finance

Next-generation financial institutions and neo-banks introduce funding competition and digital-native balance sheet models. Competitive deposit rates, API-driven architecture, and alternative yield structures can alter funding costs across the system.

If funding spreads compress, net interest margins adjust. Lending capacity, capital allocation incentives, and risk pricing re-calibrate.

Equity leadership and funding infrastructure are not separate domains. Both respond to liquidity regimes and technological leverage.

When capital becomes more modular, entry barriers fall.

Liquidity as the Overlay

None of these shifts operate outside liquidity conditions. Breadth expansion tends to persist when funding costs stabilize and credit spreads remain contained. In tighter regimes, capital often re-concentrates into perceived safety.

The durability of any rotation depends on liquidity alignment. Productivity diffusion alone cannot sustain valuation expansion without supportive credit conditions.

But when liquidity and productivity move in tandem, market participation broadens.

Concentration Risk and Allocation

For allocators, the relevant question is not whether mega-cap technology declines. It is whether concentration risk warrants recalibration.

If earnings leverage becomes more distributed across sectors and market capitalizations, portfolio construction assumptions shift. Index dominance that once reflected structural inevitability may reflect prior liquidity conditions more than enduring hierarchy.

Real yields influence duration premiums. AI influences cost structures. Funding competition influences capital allocation. Together, they shape leadership.

Diffusion Rather Than Disruption

Artificial intelligence does not inherently displace established leaders. Nor does real-yield normalization erase scale advantages. What these forces may do is narrow the relative gap between incumbents and agile competitors.

When productivity tools democratize and discount rates recalibrate, leadership tends to broaden.

Whether that broadening evolves into a sustained supercycle depends on the persistence of liquidity support and earnings delivery. But the structural ingredients — yield repricing, AI diffusion, funding modularity — are measurable.

Markets eventually price structure.

At CoinEpigraph, we are committed to delivering digital-asset journalism with clarity, accuracy, and uncompromising integrity. Our editorial team works daily to provide readers with reliable, insight-driven coverage across an ever-shifting crypto and macro-financial landscape. As we continue to broaden our reporting and introduce new sections and in-depth op-eds, our mission remains unchanged: to be your trusted, authoritative source for the world of crypto and emerging finance.

— Ian Mayzberg, Editor-in-Chief

The team at CoinEpigraph.com is committed to independent analysis and a clear view of the evolving digital asset order.

To help sustain our work and editorial independence, we would appreciate your support of any amount of the tokens listed below. Support independent journalism:

BTC: 3NM7AAdxxaJ7jUhZ2nyfgcheWkrquvCzRm

SOL: HxeMhsyDvdv9dqEoBPpFtR46iVfbjrAicBDDjtEvJp7n

ETH: 0x3ab8bdce82439a73ca808a160ef94623275b5c0a

XRP: rLHzPsX6oXkzU2qL12kHCH8G8cnZv1rBJh TAG – 1068637374

SUI – 0xb21b61330caaa90dedc68b866c48abbf5c61b84644c45beea6a424b54f162d0c

and through our Support Page.

🔍 Disclaimer: CoinEpigraph is for entertainment and information, not investment advice. Markets are volatile — always conduct your own research.

COINEPIGRAPH™ does not offer investment advice. Always conduct thorough research before making any market decisions regarding cryptocurrency or other asset classes. Past performance is not a reliable indicator of future outcomes. All rights reserved | 版权所有 ™ © 2024-2029.