From Senegal to Cameroon, the CFA franc offers stability but limits monetary autonomy—leaving control of critical settlement rails partially anchored outside the continent.

By CoinEpigraph Fintech Desk | February 12, 2026

Morning markets open in Dakar.

Cash registers ring in Abidjan.

Payroll clears in Yaoundé.

On paper, these are independent economies — sovereign flags, elected governments, central banks with official seals.

Yet the currency moving through each of those systems traces its design to Paris.

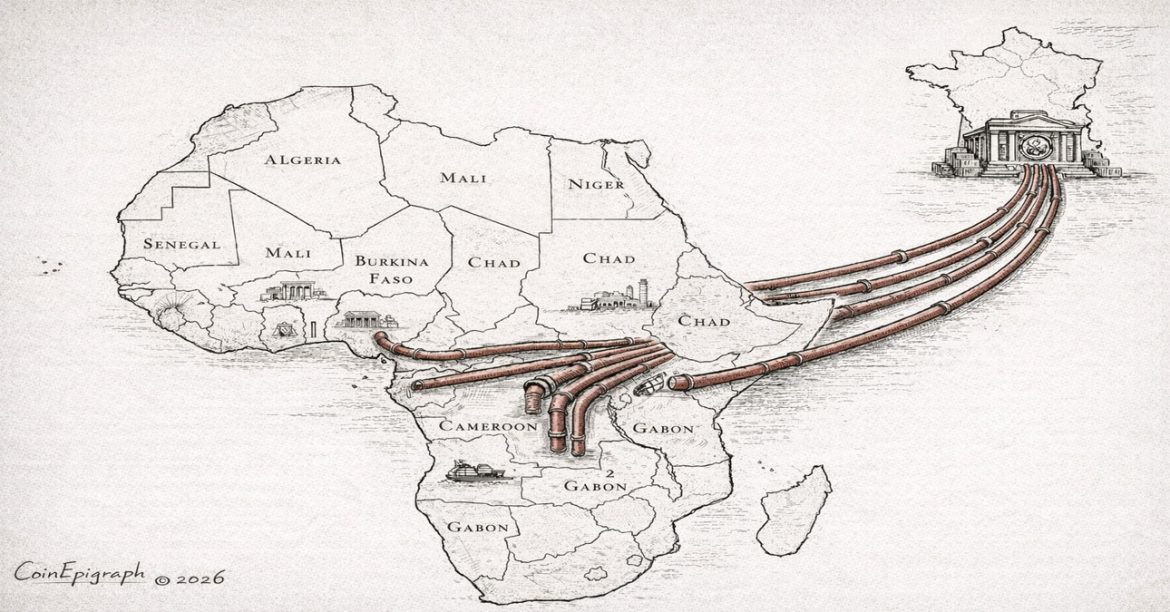

The CFA franc is one of the least discussed — and most structurally consequential — monetary arrangements in modern finance. Used across fourteen countries, including Senegal and Cameroon, it is pegged to the euro and supported by convertibility guarantees historically tied to the French Treasury.

The arrangement offers stability.

It also exports control.

And in monetary systems, control is never incidental.

It is the system.

Stability has a sponsor

The CFA framework was originally designed in the mid-20th century as a way to anchor former French colonies to a predictable exchange regime. The logic was straightforward: reduce inflation, stabilize trade, and preserve convertibility with Europe.

For countries navigating fragile post-independence transitions, stability mattered. It still does.

Currency collapses erase savings.

Hyperinflation dissolves trust.

Volatility punishes the poor first.

A hard peg can feel like insurance.

And for decades, the CFA zone delivered precisely what it promised: lower inflation relative to many peers, predictable exchange rates, easier external trade.

To policymakers, those features are not trivial.

They are survival tools.

Which is why the system endured.

But pegs come with gravity

Every fixed currency regime solves one problem by creating another.

You gain stability.

You lose flexibility.

When your exchange rate is externally anchored, domestic policy begins to bend around it.

Interest rates must align.

Reserve management tightens.

Capital controls become delicate.

Industrial strategy narrows.

Over time, those constraints accumulate.

Not dramatically. Quietly.

Like a ceiling that sits just a little too low.

You don’t notice it at first.

Until you try to stand up straight.

Monetary sovereignty, deferred

At the heart of the CFA debate is a question that rarely makes headlines but determines everything downstream:

Who ultimately controls the money supply?

Because whoever controls supply controls:

credit expansion,

fiscal maneuvering,

crisis response,

development speed.

The CFA structure, by design, limits unilateral discretion.

Convertibility guarantees require discipline.

Discipline limits improvisation.

When global shocks hit — commodity slumps, capital flight, external debt squeezes — governments cannot simply reprice their currency or print aggressively to smooth the blow. The peg becomes both anchor and tether.

There is safety in that restraint.

There is also confinement.

It is the monetary equivalent of living in a building where the thermostat is locked.

You may appreciate the consistency.

You may also wish, occasionally, for the key.

The invisible cost of control

Critics often frame the CFA in moral terms — colonialism, exploitation, dependency.

Those words carry emotional charge. They also obscure the mechanics.

The real cost is more technical.

More procedural.

And, arguably, more consequential.

Limited policy space affects:

- credit availability for local businesses

- the ability to finance infrastructure domestically

- responses to youth unemployment

- incentives for industrialization

- the development of local capital markets

None of these fail overnight. They erode gradually.

Investment hesitates.

Entrepreneurs look elsewhere.

Sovereign borrowing grows more expensive.

Growth slows, not because of one dramatic misstep, but because the system has less room to breathe.

The constraint rarely announces itself.

It simply narrows the path.

Architecture, not ideology

It’s tempting to cast the CFA debate as ideological — Europe versus Africa, legacy power versus independence.

But money rarely behaves ideologically.

Money behaves architecturally.

It follows pipes.

The question is not whether France exerts influence. Influence is inevitable wherever convertibility is guaranteed.

The question is structural:

Who maintains the rails?

Who provides the backstop?

Who sets the terms when stress arrives?

In the CFA system, those answers historically sit outside the continent.

And that externality — more than rhetoric — is what troubles a new generation of policymakers.

Because sovereignty, in practice, means being able to fail and recover on your own terms.

Not someone else’s.

A changing landscape

The timing of this debate is not accidental.

Africa’s financial ecosystem is evolving quickly.

Mobile money has leapfrogged traditional banking.

Regional trade blocs are deepening.

Digital settlement rails are emerging.

Blockchain-based payment networks are quietly expanding across borders.

The old equation — stability versus sovereignty — is no longer binary.

Technology is introducing a third variable: optionality.

If cross-border payments can clear instantly through decentralized rails, if reserves can be diversified digitally, if domestic currencies can interoperate without external custodians, the calculus shifts.

Not overnight. But perceptibly.

The peg begins to look less like protection and more like habit.

And habits, in finance, eventually meet arithmetic.

History tends to repeat the same pattern

Monetary systems rarely change through protest alone.

They change when new infrastructure makes the old one unnecessary.

SWIFT didn’t disappear because people disliked it.

It’s being challenged because alternatives exist.

Wirehouses didn’t fade because investors complained.

They faded because online brokers reduced friction.

The same principle applies here.

If regional digital currencies or tokenized settlement systems can deliver stability without outsourcing control, political pressure becomes secondary.

Economics does the work.

Lower cost.

Faster settlement.

Local custody.

Those forces behave like gravity.

They don’t argue.

They pull.

The quieter read

From a distance, the CFA arrangement looks like a historical relic. Up close, it functions more like a living compromise — stability purchased with partial autonomy.

For decades, that trade made sense.

The world now looks different.

Young populations, mobile-first economies, and digital rails are rewriting what monetary independence can mean. Sovereignty is no longer just about issuing notes. It’s about who operates the settlement layer beneath them.

And settlement layers are becoming programmable.

Which means the future of monetary control may not be negotiated in Paris or Brussels or any capital at all.

It may be coded.

Bottom line

The CFA franc is neither purely safeguard nor purely constraint. It is infrastructure — and infrastructure always shapes outcomes more than ideology does.

For years, the arrangement provided calm in volatile waters.

The question now is whether calm remains enough.

Because the next phase of financial development across West and Central Africa will require not just stability, but maneuverability.

And maneuverability requires control.

Currencies rarely leave quietly. They linger. They adapt. They persist long after the flags change.

But eventually, every monetary system faces the same test:

Does it serve the people using it — or the architecture that built it?

The answer, as always, lies in the rails.

At CoinEpigraph, we are committed to delivering digital-asset journalism with clarity, accuracy, and uncompromising integrity. Our editorial team works daily to provide readers with reliable, insight-driven coverage across an ever-shifting crypto and macro-financial landscape. As we continue to broaden our reporting and introduce new sections and in-depth op-eds, our mission remains unchanged: to be your trusted, authoritative source for the world of crypto and emerging finance.

— Ian Mayzberg, Editor-in-Chief

The team at CoinEpigraph.com is committed to independent analysis and a clear view of the evolving digital asset order.

To help sustain our work and editorial independence, we would appreciate your support of any amount of the tokens listed below. Support independent journalism:

BTC: 3NM7AAdxxaJ7jUhZ2nyfgcheWkrquvCzRm

SOL: HxeMhsyDvdv9dqEoBPpFtR46iVfbjrAicBDDjtEvJp7n

ETH: 0x3ab8bdce82439a73ca808a160ef94623275b5c0a

XRP: rLHzPsX6oXkzU2qL12kHCH8G8cnZv1rBJh TAG – 1068637374

SUI – 0xb21b61330caaa90dedc68b866c48abbf5c61b84644c45beea6a424b54f162d0c

and through our Support Page.

🔍 Disclaimer: CoinEpigraph is for entertainment and information, not investment advice. Markets are volatile — always conduct your own research.

COINEPIGRAPH does not offer investment advice. Always conduct thorough research before making any market decisions regarding cryptocurrency or other asset classes. Past performance is not a reliable indicator of future outcomes. All rights reserved ™ © 2024-2028.