By CoinEpigraph Editorial Desk | February 3, 2026

Over the past four days, more than $5 billion in crypto positions have been forcibly unwound across exchanges, marking the largest liquidation wave since early autumn. The number is large enough to attract headlines. It is also easy to misread.

This was not a referendum on digital assets.

It was a mechanical event.

Liquidations of this scale rarely signal a change in conviction. They signal a change in margin. When positions are highly levered and liquidity thins, the market doesn’t wait for sellers to decide. It decides for them. Stops cascade. Collateral evaporates. The tape accelerates.

What looks like panic is often plumbing.

And plumbing, in crypto as in any market, is where maturity is measured.

Forced selling, not discretionary exits

Liquidations are frequently described as “selloffs,” but that language obscures what actually happens under the hood. These are not portfolio managers reducing exposure or long-term holders reconsidering the thesis. They are automated risk systems closing positions once collateral thresholds are breached.

It is procedural.

Perpetual futures dominate much of crypto’s short-term activity. Traders borrow against margin, amplify exposure, and rely on tight ranges to maintain those positions. When volatility expands, margin buffers shrink quickly. Exchanges then force close positions to protect solvency.

Each forced close pushes price further. Each push triggers the next stop.

The result is less like a negotiation and more like a chain reaction.

By the time the dust settles, billions have changed hands without a single discretionary decision being made.

The leverage problem, not the asset problem

There is a tendency, especially outside the industry, to treat liquidation waves as proof that digital assets remain inherently unstable. That diagnosis confuses volatility with structure.

Every mature asset class experiences volatility.

Oil collapses. Equities gap. Rates markets convulse. But in those markets, depth and hedging capacity absorb stress before it compounds into cascades.

The difference is not emotion. It is architecture.

Crypto’s derivatives markets are growing, but they are still uneven. Liquidity concentrates at certain venues. Perpetuals often dictate the tempo. Spot markets, while deeper than years past, can still feel thin during stress windows.

When leverage outpaces underlying depth, instability follows.

Not because the asset lacks legitimacy — but because the rails beneath it are still scaling.

In that sense, a $5 billion unwind is less a verdict on crypto’s future and more a reminder that leverage remains ahead of infrastructure.

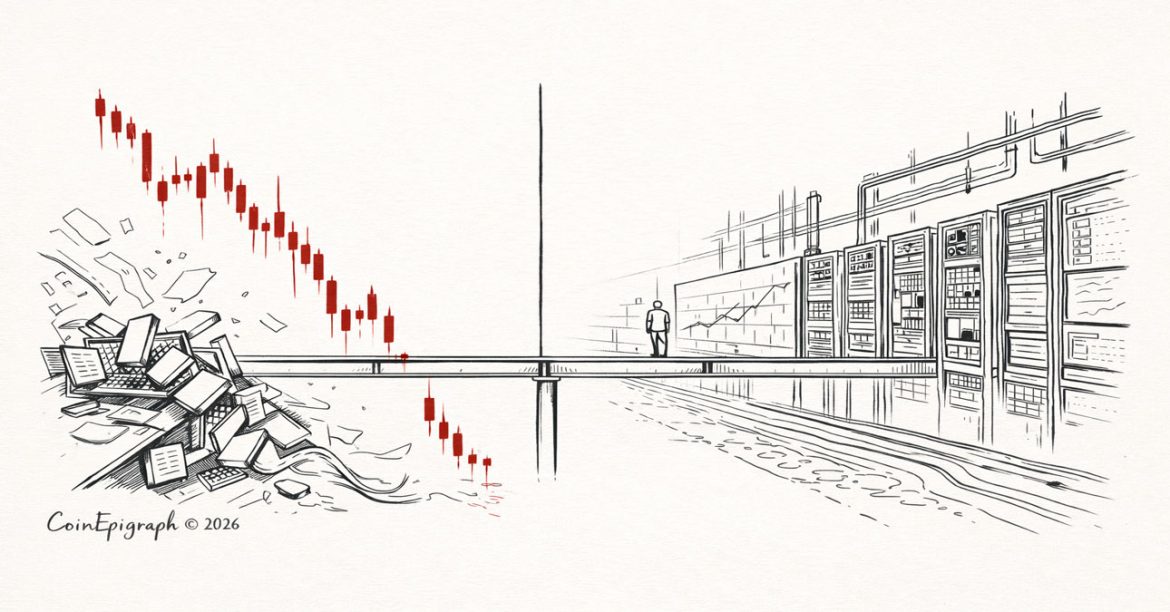

Two markets moving at different speeds

What makes this moment interesting is the contrast.

On one side, institutional adoption continues to grind forward. Custody standards tighten. Exchange-traded products accumulate assets. Corporate treasuries treat bitcoin less like a trade and more like a balance sheet component. Tokenization pilots move settlement and collateral onto faster rails.

The slow work.

The quiet work.

The type of work described recently by Fidelity Digital Assets in its forward outlook, which framed digital assets not as speculation but as emerging financial infrastructure.

On the other side, leverage still dominates the headlines. Perpetual funding rates spike. Positioning crowds. Thin liquidity windows turn routine volatility into mechanical purges.

The loud work.

These two layers coexist. They often have little to do with each other.

Yet it is the second layer that sets the tone of the news cycle.

Why these resets matter

Paradoxically, liquidation events often serve a stabilizing function once complete.

They compress excess.

They force weak hands out.

They reduce crowded positioning.

After a cascade, funding normalizes and markets tend to trade more organically. Price discovery returns to spot buyers rather than leveraged momentum.

It is messy, but it is cleansing.

Traditional markets experience similar moments. Crypto simply compresses them into shorter, more visible bursts.

What looks dramatic is often just the system recalibrating.

The institutional read

For allocators and operators, the takeaway is less sensational than the headlines suggest.

The question is not “Is crypto broken?”

It is “How quickly are the risk-transfer layers deepening?”

As derivatives mature, as collateral practices tighten, as more activity migrates to regulated wrappers and deeper spot books, these cascades should become less violent. Not disappear — markets never eliminate stress — but dampen.

That is what maturity looks like.

Not the absence of volatility, but the absorption of it.

Bottom line

Five billion dollars in liquidations sounds like a crisis. Structurally, it is a reminder.

Crypto remains a market where leverage can still outrun liquidity. When it does, the system corrects itself abruptly.

Yet beneath the noise, the longer arc remains intact: custody hardens, capital markets integrate, and digital assets continue moving — slowly, almost invisibly — into the financial mainstream.

Liquidations clear the excess.

Infrastructure endures.

And in the end, infrastructure is what lasts.

At CoinEpigraph, we are committed to delivering digital-asset journalism with clarity, accuracy, and uncompromising integrity. Our editorial team works daily to provide readers with reliable, insight-driven coverage across an ever-shifting crypto and macro-financial landscape. As we continue to broaden our reporting and introduce new sections and in-depth op-eds, our mission remains unchanged: to be your trusted, authoritative source for the world of crypto and emerging finance.

— Ian Mayzberg, Editor-in-Chief

The team at CoinEpigraph.com is committed to independent analysis and a clear view of the evolving digital asset order.

To help sustain our work and editorial independence, we would appreciate your support of any amount of the tokens listed below. Support independent journalism:

BTC: 3NM7AAdxxaJ7jUhZ2nyfgcheWkrquvCzRm

SOL: HxeMhsyDvdv9dqEoBPpFtR46iVfbjrAicBDDjtEvJp7n

ETH: 0x3ab8bdce82439a73ca808a160ef94623275b5c0a

XRP: rLHzPsX6oXkzU2qL12kHCH8G8cnZv1rBJh TAG – 1068637374

SUI – 0xb21b61330caaa90dedc68b866c48abbf5c61b84644c45beea6a424b54f162d0c

and through our Support Page.

🔍 Disclaimer: CoinEpigraph is for entertainment and information, not investment advice. Markets are volatile — always conduct your own research.

COINEPIGRAPH does not offer investment advice. Always conduct thorough research before making any market decisions regarding cryptocurrency or other asset classes. Past performance is not a reliable indicator of future outcomes. All rights reserved ™ © 2024-2028.