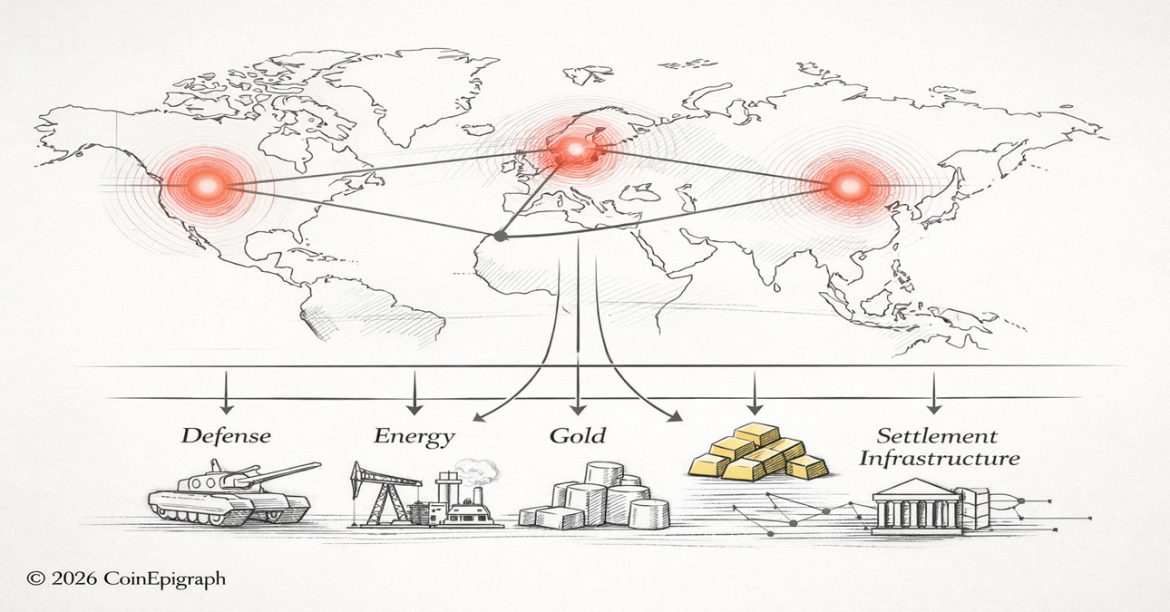

With formal nuclear constraints gone, defense spending, energy volatility, gold allocation, and settlement resilience shift from tactical trades to structural positioning.

By CoinEpigraph Editorial Desk | February 17, 2026

The expiration of New START closes the final chapter of Cold War-era nuclear constraint architecture between the United States and Russia.

For the first time in more than five decades, the two largest nuclear powers operate without binding treaty limits or formal verification structures.

This is not a return to the 1960s.

It is the emergence of a three-pole deterrence system — United States, Russia, and a rapidly expanding China — operating without numerical guardrails.

Markets do not price warheads. They price uncertainty.

The relevant shift is not immediate conflict probability. It is the widening of geopolitical risk distributions.

When predictability declines, risk premia adjust.

What Has Structurally Changed

New START capped deployed strategic warheads and delivery systems while embedding inspection and verification mechanisms. Its expiration removes both numeric ceilings and transparency obligations.

The structural change is straightforward:

Strategic arsenals are no longer constrained by formal bilateral architecture.

That does not automatically increase deployment tomorrow. It increases optionality.

Optionality, in security regimes, widens market tails.

Markets prefer ceilings.

Unbounded systems expand scenario ranges.

Definition: Geopolitical Risk Premium

A geopolitical risk premium is the incremental return demanded by investors when political or security uncertainty increases the range of possible economic outcomes.

It manifests through:

- Higher commodity volatility

- Elevated fiscal spending

- Increased safe-haven allocation

- Capital flow reorientation

It is not panic pricing. It is structural repricing.

Channel One: Defense Spending Becomes Structural

Without treaty ceilings, modernization cycles gain political durability. Missile defense systems, hypersonics, advanced surveillance, and strategic deterrence infrastructure shift from episodic debate to baseline budgeting.

Defense spending becomes less cyclical and more structural.

For markets, this implies:

- Multi-year procurement visibility

- Stable demand for advanced industrial manufacturing

- Persistent fiscal baseline elevation

Elevated defense baselines also increase Treasury issuance needs over time. That influences term premium behavior in fixed income markets.

Defense is not simply a sector allocation story. It is a fiscal architecture story.

Channel Two: Energy and Maritime Risk Repricing

Multipolar deterrence heightens bloc alignment and sanction durability. Even absent direct confrontation, insurance markets and shipping corridors begin pricing uncertainty differently.

Energy markets respond to perceived choke-point vulnerability.

That means:

- Wider oil volatility corridors

- Higher maritime insurance premiums

- Strategic inventory management

Energy transitions from pure demand-cycle trade to geopolitical buffer asset.

Infrastructure resilience becomes investable.

Channel Three: Gold as Trust Collateral

In environments of strategic fragmentation, gold often regains prominence as non-sovereign collateral.

Gold does not rely on issuer credibility. It functions outside bloc alignment.

Reserve managers operating in multipolar systems often incrementally diversify.

This is not a dollar collapse thesis. It is a diversification slope.

Gold tends to perform when trust dispersion increases.

Channel Four: Dollar Reflex vs Fiscal Arithmetic

In acute geopolitical shocks, the U.S. dollar retains safe-haven reflex.

However, sustained modernization cycles and supply-chain redundancy policies increase fiscal intensity.

This produces a dual dynamic:

- Short-term dollar strength during stress

- Long-term scrutiny of fiscal trajectory

These forces coexist.

Markets can simultaneously seek safety in U.S. assets while debating funding sustainability.

Channel Five: Settlement Redundancy

Fragmented geopolitical systems elevate the value of settlement optionality.

Settlement optionality refers to the ability to clear and transfer value across jurisdictions even when traditional correspondent banking networks face restriction.

Digital settlement infrastructure — including compliant stablecoin rails and tokenized sovereign instruments — becomes part of redundancy planning.

This is not ideological crypto adoption.

It is resilience architecture.

When geopolitical friction increases, capital seeks rails that remain operational under constraint.

Where Risk Concentrates

In a three-pole deterrence environment, systemic risk does not concentrate in weapons counts. It concentrates in economic transmission channels.

Primary concentration points include:

- Fiscal expansion and funding requirements

- Commodity volatility

- Sanctions architecture durability

- Cross-border capital mobility

These risk vectors intersect with financial infrastructure.

If global liquidity is expanding, geopolitical tension is absorbed.

If global liquidity is contracting, geopolitical uncertainty amplifies volatility.

The interaction between security regime shifts and liquidity cycles determines market intensity.

The China Variable

China’s projected arsenal expansion toward the end of the decade introduces a coordination complexity absent in bilateral deterrence.

Three-party systems historically carry greater opacity.

Opacity widens volatility corridors.

Markets respond not to numeric milestones but to transparency reduction.

Transparency stabilizes pricing. Its absence increases premium.

Not Alarmism — Re-calibration

It is critical to avoid framing this as imminent crisis.

The expiration of New START does not mandate instability. It removes structural constraints that markets had quietly internalized.

Capital allocation models adjust gradually.

Resilience sectors gain structural weight:

- Defense-industrial capacity

- Energy security infrastructure

- Hard collateral assets

- Settlement redundancy mechanisms

Markets price insurance before they price catastrophe.

Structural Conclusion

The end of treaty-based ceilings marks a shift from constrained deterrence to competitive modernization.

Markets respond to architecture:

- Fiscal architecture

- Energy architecture

- Reserve architecture

- Settlement architecture

In a three-pole nuclear era, the defining allocation theme is resilience.

Capital flows toward systems capable of operating under stress.

Geopolitical fragmentation does not halt globalization. It reshapes its plumbing.

Architecture determines resilience.

Resilience determines premium.

At CoinEpigraph, we are committed to delivering digital-asset journalism with clarity, accuracy, and uncompromising integrity. Our editorial team works daily to provide readers with reliable, insight-driven coverage across an ever-shifting crypto and macro-financial landscape. As we continue to broaden our reporting and introduce new sections and in-depth op-eds, our mission remains unchanged: to be your trusted, authoritative source for the world of crypto and emerging finance.

— Ian Mayzberg, Editor-in-Chief

The team at CoinEpigraph.com is committed to independent analysis and a clear view of the evolving digital asset order.

To help sustain our work and editorial independence, we would appreciate your support of any amount of the tokens listed below. Support independent journalism:

BTC: 3NM7AAdxxaJ7jUhZ2nyfgcheWkrquvCzRm

SOL: HxeMhsyDvdv9dqEoBPpFtR46iVfbjrAicBDDjtEvJp7n

ETH: 0x3ab8bdce82439a73ca808a160ef94623275b5c0a

XRP: rLHzPsX6oXkzU2qL12kHCH8G8cnZv1rBJh TAG – 1068637374

SUI – 0xb21b61330caaa90dedc68b866c48abbf5c61b84644c45beea6a424b54f162d0c

and through our Support Page.

🔍 Disclaimer: CoinEpigraph is for entertainment and information, not investment advice. Markets are volatile — always conduct your own research.

COINEPIGRAPH™ does not offer investment advice. Always conduct thorough research before making any market decisions regarding cryptocurrency or other asset classes. Past performance is not a reliable indicator of future outcomes. All rights reserved | 版权所有 ™ © 2024-2029.