The overlooked control layer beneath global tokenization

By CoinEpigraph Editorial Desk | February 20, 2026

Tokenization is often framed as a liquidity story.

Lower friction. Faster settlement. Fractional ownership. Global access.

Those benefits are real. But as real-world assets migrate onto programmable rails, a quieter question emerges beneath the efficiency narrative:

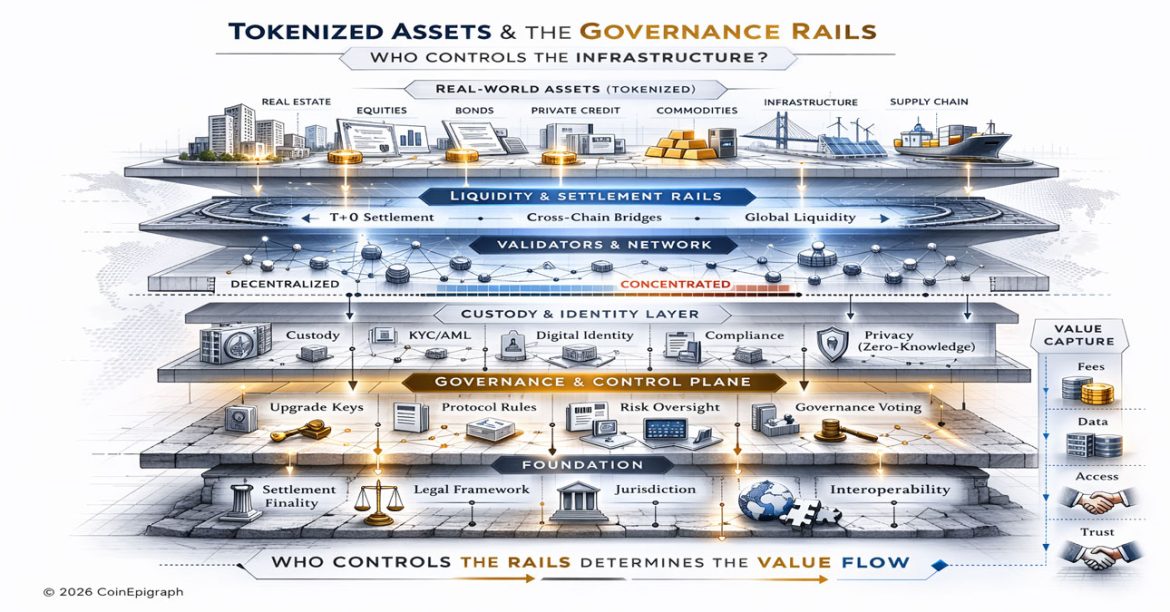

Who governs the infrastructure?

The long-run implications of tokenization may hinge less on the assets themselves and more on the control plane beneath them.

Tokenization Is a Claims Migration

At its core, tokenization is not about coins. It is about the migration of economic claims — title, revenue participation, lien priority, usage rights — into programmable settlement systems.

When equities, bonds, private credit, real estate, commodities, and operating assets move on-chain, they do not simply become digital. They become rule-bound by software.

Settlement logic becomes code.

Transfer rules become programmable.

Compliance gates become automated.

That shift introduces efficiency. It also introduces governance architecture as a first-order variable.

The token is visible.

The governance layer is not.

The Rail Stack

Control in tokenized finance does not sit in one place. It sits across layers:

- Validator or sequencer control

- Upgrade key authority

- Custody concentration

- Identity verification systems

- Stablecoin issuance control

- Cross-chain bridge operators

- Compliance gating mechanisms

Each layer carries influence over how value moves.

When assets scale into the trillions, influence over those layers becomes economically systemic.

The risk is not cryptographic failure.

It is governance concentration.

Efficiency Without Governance Hardening

The tokenization narrative emphasizes friction reduction:

- T+0 settlement

- Reduced counter-party exposure

- Lower issuance costs

- Automated income distribution

These efficiencies are meaningful. But settlement compression does not eliminate systemic leverage. It redistributes it.

If custody consolidates among a small set of institutional providers, those providers become critical nodes.

If stablecoin issuance concentrates within a narrow issuer group, liquidity flows become indirectly centralized.

If protocol upgrade authority resides with a limited governance cohort, rule changes can have wide-reaching economic impact.

Efficiency gains must be matched by governance robustness.

The Economic Power of Upgrade Authority

Traditional financial systems rely on legal and regulatory oversight for rule changes.

Programmable finance introduces a new dimension: software upgrades.

Who controls:

- Smart contract upgrade keys?

- Validator sets?

- Emergency pause mechanisms?

- Freeze authorities?

These are not theoretical concerns. They are structural features of many blockchain-based systems.

As real-world assets migrate on-chain, the power to modify protocol logic becomes the power to influence settlement behavior.

In smaller systems, this is operational risk.

In large-scale tokenization, it becomes systemic risk.

AI as Acceleration, Not Catastrophe

Concerns about AI-driven manipulation often focus on dramatic scenarios. The more realistic vector is acceleration.

AI increases the speed at which actors can:

- Detect governance vulnerabilities

- Identify liquidity choke-points

- Exploit latency between chains

- Influence governance voting processes

- Stress-test settlement bottlenecks

The risk is not an autonomous financial coup. It is automated opportunism in systems where governance remains concentrated.

Speed amplifies fragility.

The Privacy Constraint

Institutional capital does not migrate toward full transparency without safeguards.

If tokenized systems expose trading patterns, treasury positions, or collateral structures, adoption slows.

This tension drives a bifurcation:

- Public settlement rails with visible flows

- Permissioned or privacy-enhanced rails for institutional scale

The governance question then shifts:

Who controls the privacy layer?

Who sets disclosure standards?

Who arbitrates access?

Governance power expands as systems mature.

Concentration Metrics to Watch

Rather than speculating about extreme events, a more disciplined approach is to track measurable indicators:

- Validator concentration ratios

- Stablecoin market share distribution

- Custody concentration among institutional providers

- Governance participation dispersion

- Bridge liquidity dependency

- Upgrade key transparency

These metrics reveal whether tokenization is decentralizing power or relocating it.

The trajectory matters more than the headline.

Systemic Without Being Fragile

Every financial system has leverage points.

Traditional markets rely on clearinghouses, central banks, and custodial networks.

Tokenized markets rely on validators, issuers, bridges, and governance cohorts.

The difference is visibility.

Blockchain-based systems make certain concentrations easier to measure. That transparency can function as a stabilizing force — provided participants monitor it.

Systemic relevance does not require catastrophe. It requires scale.

Why This Conversation Matters Now

Tokenization is entering a phase where:

- Sovereigns are exploring digital settlement systems

- Stablecoin supply is expanding

- Real-world assets are increasingly represented on-chain

- Institutional custody solutions are consolidating

As adoption grows, governance becomes economically material.

The conversation need not be alarmist. It should be architectural.

The Strategic Balance

The long-run success of tokenized finance depends on aligning three elements:

- Settlement efficiency

- Governance dispersion

- Privacy-compatible transparency

If any one element lags, adoption friction increases.

If governance concentration outpaces asset migration, systemic leverage accumulates quietly.

If governance evolves alongside scale, programmable finance may achieve both efficiency and resilience.

The Forward View

Tokenization is unlikely to reverse. The incentives are too strong.

But as assets migrate, attention will shift from token issuance to rule control.

Who defines transfer standards?

Who holds upgrade authority?

Who arbitrates compliance?

Who governs interoperability?

The economic value captured by tokenization may ultimately accrue not only to asset holders, but to the operators of the rails beneath them.

Infrastructure maturity will determine whether tokenized markets remain competitive or become merely re-centralized.

The transition from friction reduction to governance accountability is not a crisis narrative.

It is the next phase.

At CoinEpigraph, we are committed to delivering digital-asset journalism with clarity, accuracy, and uncompromising integrity. Our editorial team works daily to provide readers with reliable, insight-driven coverage across an ever-shifting crypto and macro-financial landscape. As we continue to broaden our reporting and introduce new sections and in-depth op-eds, our mission remains unchanged: to be your trusted, authoritative source for the world of crypto and emerging finance.

— Ian Mayzberg, Editor-in-Chief

The team at CoinEpigraph.com is committed to independent analysis and a clear view of the evolving digital asset order.

To help sustain our work and editorial independence, we would appreciate your support of any amount of the tokens listed below. Support independent journalism:

BTC: 3NM7AAdxxaJ7jUhZ2nyfgcheWkrquvCzRm

SOL: HxeMhsyDvdv9dqEoBPpFtR46iVfbjrAicBDDjtEvJp7n

ETH: 0x3ab8bdce82439a73ca808a160ef94623275b5c0a

XRP: rLHzPsX6oXkzU2qL12kHCH8G8cnZv1rBJh TAG – 1068637374

SUI – 0xb21b61330caaa90dedc68b866c48abbf5c61b84644c45beea6a424b54f162d0c

and through our Support Page.

🔍 Disclaimer: CoinEpigraph is for entertainment and information, not investment advice. Markets are volatile — always conduct your own research.

COINEPIGRAPH™ does not offer investment advice. Always conduct thorough research before making any market decisions regarding cryptocurrency or other asset classes. Past performance is not a reliable indicator of future outcomes. All rights reserved | 版权所有 ™ © 2024-2029.