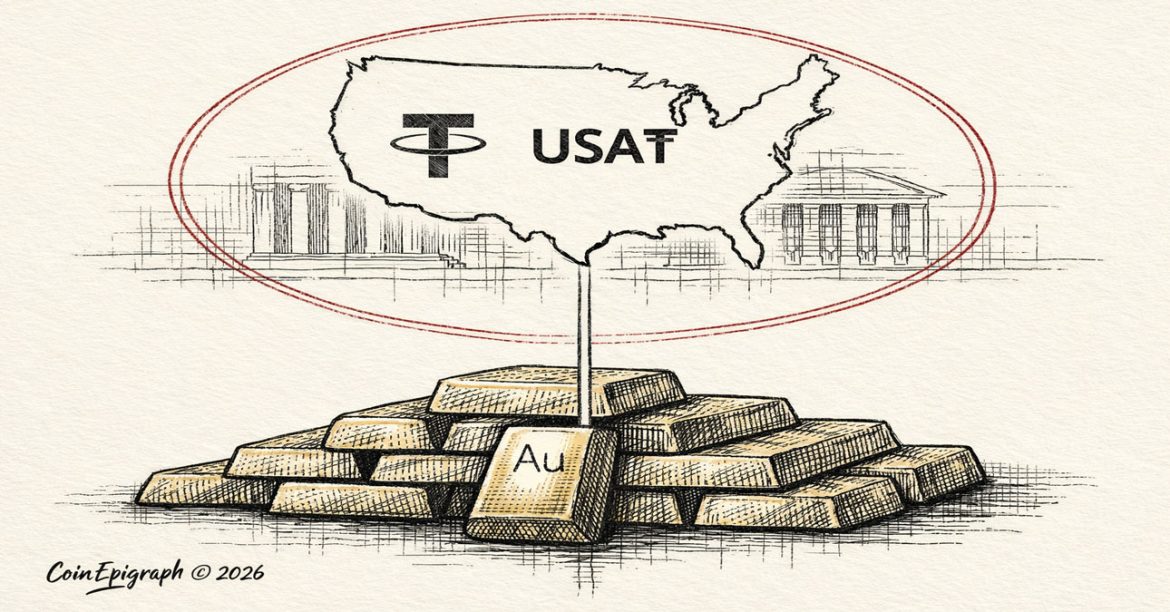

Why USA₮, USDC competition, and gold accumulation reveal a deeper reserves doctrine shift

By CoinEpigraph Editorial Desk | February 13, 2026

Stablecoins were once treated as plumbing. They are now becoming balance sheets.

Tether’s launch of a U.S.-focused stablecoin—USA₮—through Anchorage Digital Bank marks more than a product expansion. It is a jurisdictional pivot. For years, Tether’s USDT dominated globally, particularly in offshore markets and cross-border crypto flows. The United States, however, remained a different terrain—more regulated, more institutionally cautious, and more politically attentive to dollar-linked digital assets.

USA₮ signals a decision to compete inside that perimeter rather than around it.

Issued through a federally regulated crypto-native bank, the structure alters the optics and the distribution pathway. Stablecoin issuance in the United States is no longer simply a crypto-native activity; it increasingly resembles a banking function operating within a defined supervisory framework. That shift changes who can touch the asset, who can custody it, and who can integrate it into payment and settlement flows.

This is not merely about expanding market share. It is about access.

Distribution vs. Trust

On the surface, USA₮ appears to be a direct competitive move against USDC, the U.S.-oriented dollar stablecoin that has historically positioned itself as compliance-forward and institution-friendly. But the real competition is not branding.

It is distribution versus trust.

USDC gained traction domestically by aligning with regulated financial institutions and emphasizing transparency and integration into the U.S. banking ecosystem. Tether, by contrast, built global scale first. USDT became the liquidity backbone of large segments of crypto markets long before it pursued deep U.S. institutional penetration.

With USA₮, Tether is attempting to combine global liquidity depth with domestic regulatory anchoring. The question is whether scale can translate into institutional comfort once issuance moves inside a federal banking structure.

If successful, the move normalizes Tether within the U.S. settlement stack. If not, it remains bifurcated: dominant abroad, constrained at home.

Either outcome reshapes the competitive landscape.

The Gold Signal

At the same time that Tether moves toward U.S. regulatory integration, it has increased its allocation to physical gold within its broader corporate portfolio. Public reporting indicates meaningful gold accumulation and a target allocation that places gold as a material reserve component.

This deserves attention—not because gold is unusual, but because of where it sits.

Stablecoin reserves are typically composed of short-duration U.S. Treasuries, cash equivalents, and highly liquid instruments. These assets prioritize redemption certainty and duration stability. Gold introduces a different dimension. It is not duration exposure in the traditional sense. It is not counterparty risk in the same way. It is collateral outside the sovereign yield curve.

Inclusion of gold within a reserve strategy is not diversification in the retail sense. It is structural hedging. It suggests an awareness of long-tail monetary scenarios—currency debasement risk, sovereign stress, or duration volatility—without making declarative predictions.

Gold does not generate yield. It absorbs uncertainty.

That distinction matters.

XAUT Is Not the Same Thing

Tether also operates Tether Gold (XAUT), a separate tokenized gold product representing ownership of specific bullion bars stored in Switzerland. XAUT is customer-facing, commodity-backed, and designed as a tokenized representation of allocated gold.

It should not be conflated with corporate reserve composition.

XAUT is an asset wrapper.

Corporate gold allocation is balance-sheet doctrine.

One provides tokenized exposure to bullion. The other expresses how an issuer chooses to structure its own collateral base. The strategic implications of each differ significantly.

Maintaining that distinction is essential to understanding what Tether is doing.

Dual Posture: Integration and Insulation

Taken together, the launch of USA₮ and the accumulation of physical gold suggest a dual posture.

On one axis, Tether moves toward integration—operating within U.S. regulatory frameworks, leveraging a federally chartered banking partner, and positioning itself alongside domestically distributed stablecoins.

On another axis, it increases insulation—holding a meaningful portion of reserves in an apolitical asset historically associated with monetary hedging rather than yield optimization.

These moves are not contradictory. They operate at different layers.

Integration addresses permission and distribution.

Insulation addresses regime uncertainty.

Stablecoins increasingly function as private-sector reserve vehicles. When issuance strategy and reserve composition shift simultaneously, the pattern warrants analysis. It reflects more than incremental product development.

Stablecoins as Private Reserve Managers

The stablecoin model is often described as simple: issue tokens against dollars and short-term securities, provide redemption, maintain liquidity. That description understates what the largest issuers have become.

At scale, stablecoin issuers manage portfolios that resemble medium-sized sovereign reserve funds. They allocate across duration, liquidity tiers, and collateral types. They navigate regulatory constraints and counterparty exposures. They consider geopolitical and monetary risk.

The difference is that their liabilities settle in real time.

This combination—portfolio management on one side, instant redemption pressure on the other—creates a structural tension. It demands reserve discipline and risk awareness beyond basic cash management.

Tether’s recent actions suggest it is operating with that tension in mind.

What the Market Is Missing

Coverage of USA₮ will focus on competitive positioning. Coverage of gold accumulation will focus on portfolio returns or optics. Neither captures the deeper structural layer.

The relevant questions are not:

- Who wins U.S. market share?

- How much gold is enough?

The relevant questions are:

- How are stablecoin issuers positioning for multi-regime liquidity environments?

- What does reserve composition reveal about long-term confidence in duration and sovereign exposure?

- How does regulatory integration alter redemption behavior and distribution channels?

Stablecoins no longer sit at the edge of the financial system. They intersect with Treasury markets, banking charters, and global liquidity flows. As they mature, their reserve doctrine becomes a macro signal.

That signal is subtle. It is not a forecast. It is preparation.

A Structural Moment

Tether’s American turn does not declare a new monetary order. It does not displace existing stablecoins overnight. It does not negate U.S. dollar dominance.

What it does reveal is a maturing issuer adapting on two fronts simultaneously: jurisdiction and collateral.

If stablecoins are evolving from crypto utilities into systemic settlement instruments, their internal balance sheets become as important as their circulating supply.

Markets will continue to debate volatility, adoption, and regulation. But beneath those debates, reserve composition and issuance architecture are quietly redefining what stablecoins represent.

Not just digital dollars.

But programmable balance sheets operating inside—and sometimes alongside—the existing financial order.

At CoinEpigraph, we are committed to delivering digital-asset journalism with clarity, accuracy, and uncompromising integrity. Our editorial team works daily to provide readers with reliable, insight-driven coverage across an ever-shifting crypto and macro-financial landscape. As we continue to broaden our reporting and introduce new sections and in-depth op-eds, our mission remains unchanged: to be your trusted, authoritative source for the world of crypto and emerging finance.

— Ian Mayzberg, Editor-in-Chief

The team at CoinEpigraph.com is committed to independent analysis and a clear view of the evolving digital asset order.

To help sustain our work and editorial independence, we would appreciate your support of any amount of the tokens listed below. Support independent journalism:

BTC: 3NM7AAdxxaJ7jUhZ2nyfgcheWkrquvCzRm

SOL: HxeMhsyDvdv9dqEoBPpFtR46iVfbjrAicBDDjtEvJp7n

ETH: 0x3ab8bdce82439a73ca808a160ef94623275b5c0a

XRP: rLHzPsX6oXkzU2qL12kHCH8G8cnZv1rBJh TAG – 1068637374

SUI – 0xb21b61330caaa90dedc68b866c48abbf5c61b84644c45beea6a424b54f162d0c

and through our Support Page.

🔍 Disclaimer: CoinEpigraph is for entertainment and information, not investment advice. Markets are volatile — always conduct your own research.

COINEPIGRAPH does not offer investment advice. Always conduct thorough research before making any market decisions regarding cryptocurrency or other asset classes. Past performance is not a reliable indicator of future outcomes. All rights reserved ™ © 2024-2028.